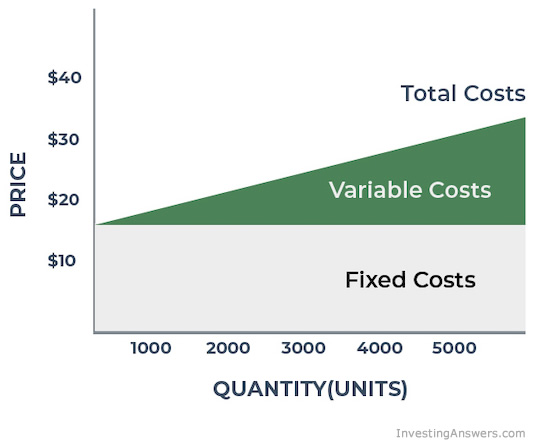

However, it’s very easy to incorporate variable costs in the sales price to make a profit since the cost is fixed per unit. To budget for total variable costs, you’ll need a good estimate of the number of sunglasses produced. Regardless of how many sunglasses are produced, the variable cost per unit is $25. To illustrate this concept, view the table below and note how the costs change as more sunglasses are produced. In addition, there are fixed costs of $500, which represents the equipment that was used. It cost $5 in raw materials and $20 in direct labor to create one pair of sunglasses. Let’s consider the example of a company that produces sunglasses. With variable expenses, the per unit expense remains constant while the total expense increases with production. Variable expenses are often volume-related, such as the amount of time your employees work per week.Variable expenses may increase or decrease based on your output because you’ll need to buy more raw goods and spend more on hourly labor to produce more output.

Variable expenses fluctuate depending on external factors, such as changes to the price per unit of electricity or fuel.Here are some of its key characteristics:

Variable Expenses DefinedĪ variable expense is a cost that changes depending on your production level. A fixed expense doesn’t change with the level of usage or production, such as the rent paid for a building, whereas a variable expense changes with the production or the amount used, such as how your electric bill varies with the amount of electricity used. Expenses in accounting can be either variable or fixed. An expense is a cost incurred by a business in its operations to produce revenues.

0 kommentar(er)

0 kommentar(er)